The Real Power of SIPs

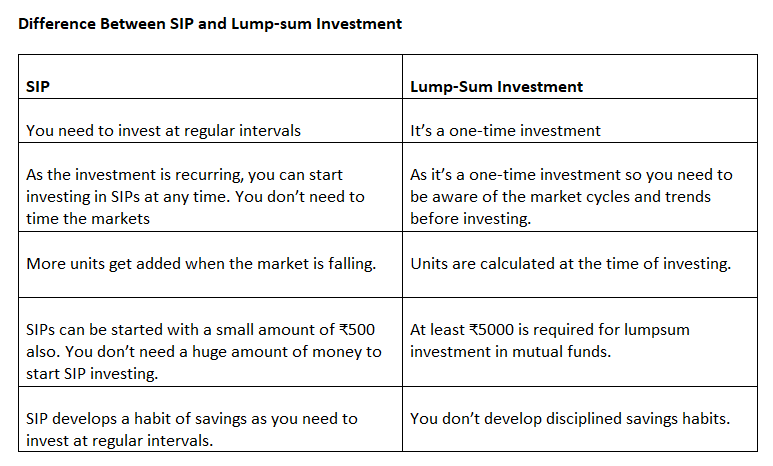

Pune, 29 August 2023: In the last few years, people have started investing in SIPs instead of traditional recurring deposits. It helps you systematically achieve your investment goals. Moreover, you can start a SIP with a small amount.

It’s very easy to calculate SIP Returns with the help of the SIP Return Calculator. In this article, we will understand the real power of SIPs. Before that let’s understand what is SIP and how it works.

What is SIP?

SIP means systematic investment plan. Through SIP you can invest a fixed amount in mutual funds at a fixed interval. The amount can be as low as ₹500 and the intervals can be weekly, monthly, quarterly etc.

This instalment of SIP can be directly deducted from your bank account through the standing instructions. It develops a disciplined approach in investors towards investing.

How Does the SIP Works?

When you apply for SIP, a standing instruction is initiated. So, at every fixed interval the fixed amount of SIP will be deducted from your bank account.

Through each instalment of SIP, you buy the units of mutual funds based on their Net Asset Value (NAV). These units keep on adding with the SIPs and get accumulated till the tenure of your investment.

When you redeem these units, the amount based on the present NAV gets credited into your account. You can make use of the SIP Return Calculator to calculate SIP Returns.

Power of SIP in Investing

SIP is a very powerful investing tool which helps you to create wealth. Let’s understand how real power is created through SIP.

⦁ Compounding

SIP brings the power of compounding. You invest a small amount of money monthly or at regular intervals. Your monthly returns get reinvested.

So, in the long term, these returns create a huge corpus amount. By investing regularly, you can achieve your investment goals.

⦁ Rupee Cost Averaging

The second important power that SIP brings is the Rupee Cost Averaging. Through SIP you are investing a certain fixed amount every month.

So, when the market falls you can buy more units and when the market goes up then you can buy fewer units. Here the volatility factor reduces due to which the overall gain increases.

⦁ Affordable

SIPs are very affordable to everyone. You don’t require a big lump sum amount to start investing in SIPs. Even a small amount of ₹500 is enough to start investing in SIP.

With the increase in your income, you can then increase your SIP amount. This way, you can start investing in SIP even for a small amount.

⦁ Disciplined Approach

SIP investing brings a disciplined approach to you. In fact, it’s a very good investment option if you don’t have enough knowledge about the markets. Every month you need to invest a fixed amount in SIP.

This amount gets deducted from your bank account. This develops a savings habit in you.

⦁ No Need to Time the Market

SIP brings the power to enter the market without timing the market. When the markets are good then you will get limited shares. But if markets are not favourable then you will get more shares. So, the averaging works here and your portfolio gets balanced returns.

⦁ Flexible Tenure

SIPs offer you the flexibility of tenure. There is no minimum or maximum tenure for investment. You can invest for the period you want.

Power of Rupee Cost Averaging in SIPs

Investing in SIP gives you the huge benefit of rupee cost averaging. You invest in SIP at regular intervals. This can be monthly, weekly, quarterly etc. With each SIP investment, you buy mutual units at Net Asset Value (NAV). Each time the NAV is different.

This average out the cost of buying mutual funds units. You buy the units at low prices and sell them at high. This is basically the concept of rupee cost averaging.

Rupee cost averaging basically helps you to reduce the impact of market volatility. You buy more when markets are low and you buy less when markets are high. This way the value of an investment is maximised in the long term.

Conclusion

SIP is a powerful investment vehicle for wealth creation and fulfilment of financial goals. It comes with the power of compounding and rupee cost averaging. Before starting your SIP use SIP Return Calculator in order to calculate SIP Returns.

Frequently Asked Questions

⦁ Is SIP investment 100% safe?

SIP is a very safe method of investing in mutual funds. Here a specific amount of investment is required to be invested at regular intervals. Due to this, your investment is averaged out which helps you to maximise returns. But still, as the investments are in mutual funds so they are subject to market risk. So, invest carefully.

⦁ Is SIP better than Fixed Deposit?

SIP and Fixed Deposits are different financial tools and they both have their own investment objectives hence it is not fair to compare. However, SIPs have some advantages over FDs, such as the benefit of flexibility of investment, diversification across asset classes, potential higher returns since you can invest in the equity market, etc. However, you need to choose your investment according to your financial goals and asset allocation.

⦁ How can one become rich with SIP?

Starting a SIP at an early age and keeping it regular without any bounces can make you rich in the long run. Even first-time investors can create wealth through regular investments in SIP with even a small amount.