Unlocking Wealth: Goal-Based Financial Planning for Future Financial Success

Pune, 13 APril 2024: In an era where financial stability and security are paramount, individuals are increasingly turning to goal-based financial planning as a strategic approach to managing their finances. This method, which emphasizes setting specific objectives and crafting personalized financial strategies to achieve them, is gaining traction as people seek to navigate the complexities of modern money management.

Goal-based financial planning is not merely about accumulating wealth; it’s about aligning financial decisions with life goals, whether it’s purchasing a home, funding education, or retiring comfortably. By breaking down overarching objectives into manageable milestones, individuals can create a roadmap that guides them towards financial success.

One of the key benefits of goal-based financial planning is its ability to optimize resource allocation. By understanding the financial commitment required for each goal and assessing one’s current financial situation, individuals can make informed decisions about how to allocate their resources most efficiently.

Consider this scenario: Suppose you’re saving for your child’s education, and she’s currently five years old, meaning you have a twelve-year horizon until she begins college. With this longer timeframe in mind, you can adopt a strategy of investing more aggressively for the initial 8-9 years to maximize potential returns, perhaps considering options like direct equity or equity mutual funds. As your goals draw nearer, you can gradually transition your investments into safer assets such as debt funds or fixed deposits to safeguard your accumulated wealth and ensure you’re well-prepared to fulfil your children`s educational goals

Implementing goal-based financial planning requires discipline and consistency. It involves setting realistic goals, seeking professional guidance when needed (very much optional if someone can do it by their own), and regularly reviewing progress towards those goals. While flexibility is essential to adapt to changing life circumstances, staying committed to the overarching plan is crucial for long-term success.

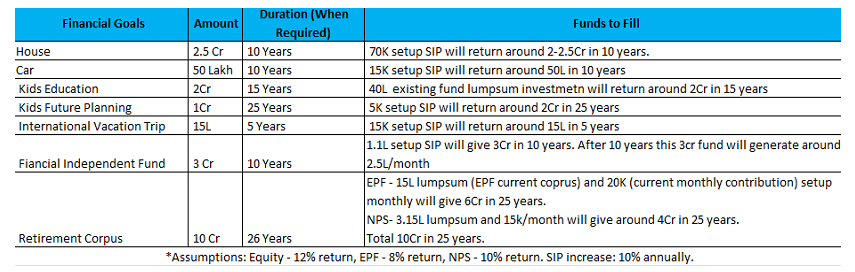

To illustrate goal-based financial planning more effectively, let’s delve into an example. Consider Vyom, aged 35, and his 33-year-old wife, with a 3 years old child. Assume, presently, Vyom family has approximately 50 lakhs in savings, and they can save around 2.2 lakhs monthly. Here’s a rough

outline of their goals:

If they execute a well-thought-out plan and make sound investment decisions, they expect to accomplish the majority of their goals within a span of 10 years. This strategy aims to amass a corpus of around 3 crore, serving as their financial independence fund to meet future basic expenses. Assuming their 3 crore corpus generates a 10% return, they expect an annual return of 30 lakhs or 2.5 lakhs per month. From this return, if they reinvest 12 lakhs to offset inflation, their fund would grow to 3.12 crores the following year. Even with this reinvestment, they would still have approximately 18 lakhs annually (1.5 lakhs/month) to cover their basic expenses.

In conclusion, goal-based financial planning is emerging as a fundamental approach to financial management in today’s fast-paced world. By setting clear objectives, creating tailored strategies, and staying disciplined in execution, individuals can pave the way for a secure and prosperous financial future. As the paradigm shifts towards goal-oriented finance, embracing this methodology is key to unlocking true financial freedom and peace of mind.

About Author:

Hradayesh Pathak holds an MBA in finance from XLRI Jamshedpur and has successfully passed CFA Level 2