On his first death anniversary, Ministry of Finance remembers former minister late Arun Jaitley’s contribution to GST implementation

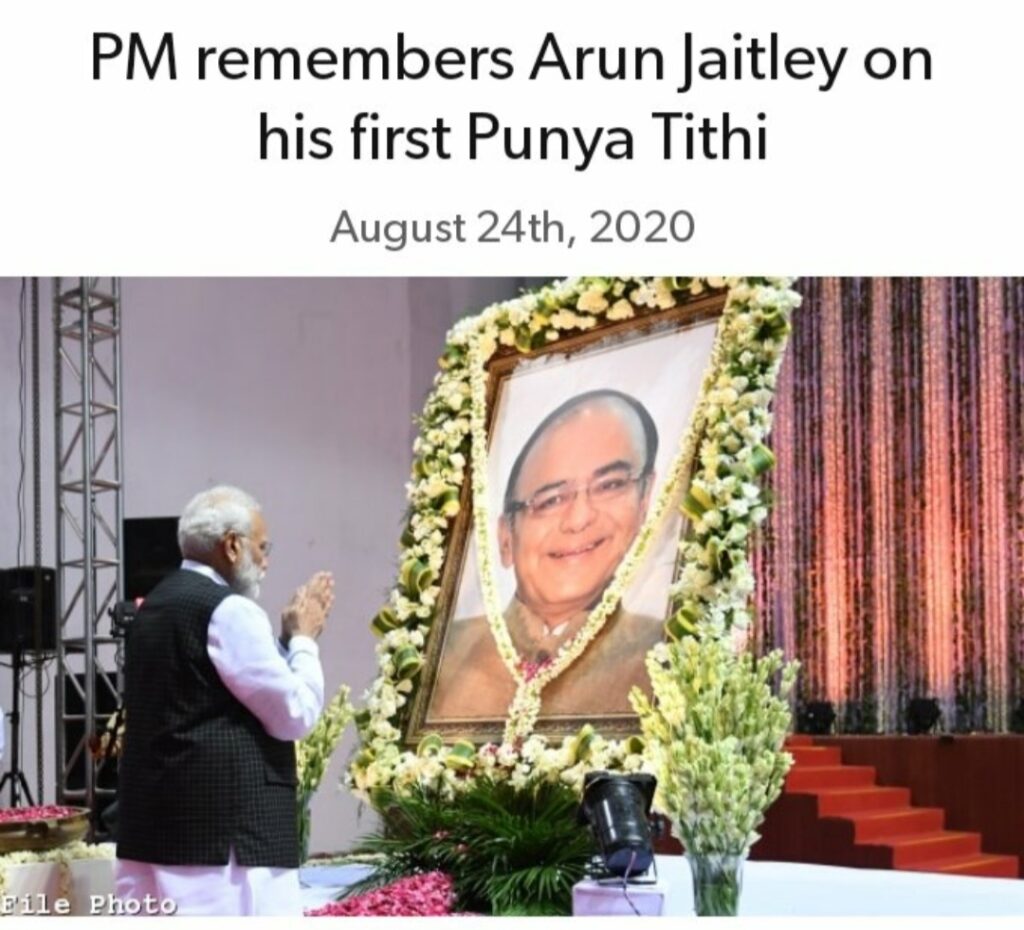

Pune, August 23, 2020: Taxpayer base has almost doubled to 1.24 crore. GST has reduced the rate at which people have to pay tax, stated the Union Ministry of Finance, on Twitter, on Monday. On the first death anniversary of former union minister and senior BJP leader Arun Jaitley, the Ministry and current Finance Minister Nirmala Sitharaman shared a series of tweets to pay respect to Jaitley, and applaud his contributions and the key role that he played in the implementation of Goods and Services Tax (GST).

“Before GST, the combination of VAT, Excise, Central Sales Tax and the cascading effect of tax on tax resulted in the standard rate of tax being as high as 31% in many cases. The multiple markets across India, with each state charging a different rate of tax, led to huge inefficiencies and costs of compliance. Under GST, compliance has been improving steadily.,” stated the tweets by the Ministry of Finance.

Here are some of the benefits of the implementation of GST, as mentioned by the Ministry of Finance:

Common-use items such as hair oil, toothpaste and soap have seen their tax rates come down from 29.3% in the pre-GST era to just 18% under GST. Most items of daily use are in 0 or 5% slab.

Cattle feed, aquatic feed and poultry feed have all been kept at a Nil rate in GST, as have all kinds of seeds. In other words, these vital inputs in the agricultural process do not attract any tax under the GST system.

Tax on cinema tickets, earlier between 35% to 110%, has been brought down to 12% and 18% in the GST regime.

Construction of residential complexes saw a steep reduction in rates to 5% in general and 1% for affordable houses.