Paras Defence’s IPO sees vigorous response from retail investors; Issue subscribed 16.57 times on Day 1

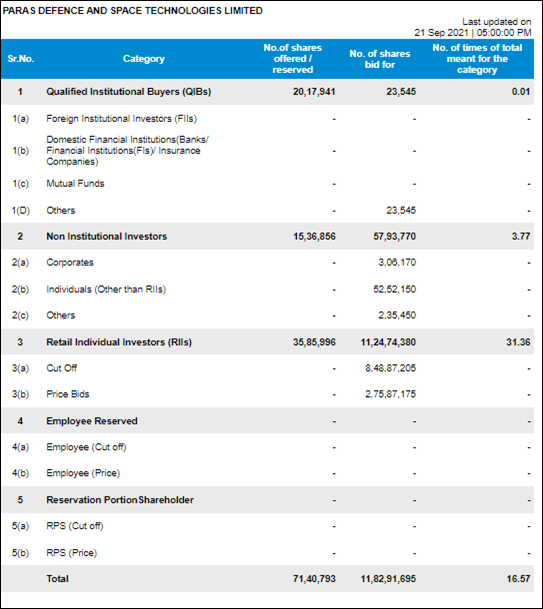

Mumbai, September 21, 2021: Paras Defence and Space Technologies Limited (“Company”); one of the ‘Indigenously Designed Developed and Manufactured Company’ (“IDDM”) category private sector companies in India, primarily engaged in designing, developing, manufacturing and testing of a wide range of defence and space engineering products and solutions, received bids of 11,82,91,695 shares against the offered 71,40,793 equity shares, as per the 5:00 pm data available on the bourses.

The portion reserved for retail investors was subscribed 31.36 times and the Non-Institutional Investor category was subscribed 3.77 times, While the Qualified Institutional Buyer category was subscribed 0.01 times. The Issue was subscribed 16.57 times.

The Offer comprises of a fresh issuance of Equity Shares aggregating up to ₹ 140.6 crores (“Fresh Issue”) and an offer for sale of up to 17,24,490 Equity Shares by Selling Shareholders.

The Company raised Rs. 51 crores through the Anchor Book from 5 investors. The Company had allocated 29,27,485 equity shares at an upper band of Rs. 175 per equity share on Monday, September 20, 2021 to Anchor Investors.

Marquee investors includes Ashoka India Equity Investment Trust, Abakkus Emerging Opportunities Fund, Saint Capital Fund, Nippon Small Cap Fund and HDFC Focused 30 Fund.

Anand Rathi Advisors Limited is the book running lead manager to the Offer (“BRLM”).