Unlocking Wealth: The Power of Direct Mutual Funds in the Fintech Era

Pune, 19th January 2024: Traditional mutual fund investments have long been associated with intermediaries, often leading to additional costs and diminished returns. However, the financial landscape is undergoing a seismic shift with the rise of fintech apps, democratizing investing and offering direct plans that bypass brokers or distributors. This transformative change is poised to revolutionize how Indian’s approach wealth creation.

In a landmark move in September 2012, the Securities and Exchange Board of India (SEBI) issued a circular that marked a pivotal moment in the investment landscape. The circular mandated mutual funds and asset management companies to establish distinct plans for direct investments, a strategy where investors could bypass intermediaries. This directive reduced expense ratios by excluding distribution expenses and commissions.

Advantages of Direct Mutual Funds: Lowering Costs, Maximizing Returns -Direct mutual funds emerge as the clear frontrunners for savvy investors, presenting a host of advantages. These include lower expense ratios, the absence of distributor commissions, and the potential for higher returns. Fintech apps, with their innovative platforms, are pivotal in not only highlighting these benefits but also simplifying the investment process for investors.

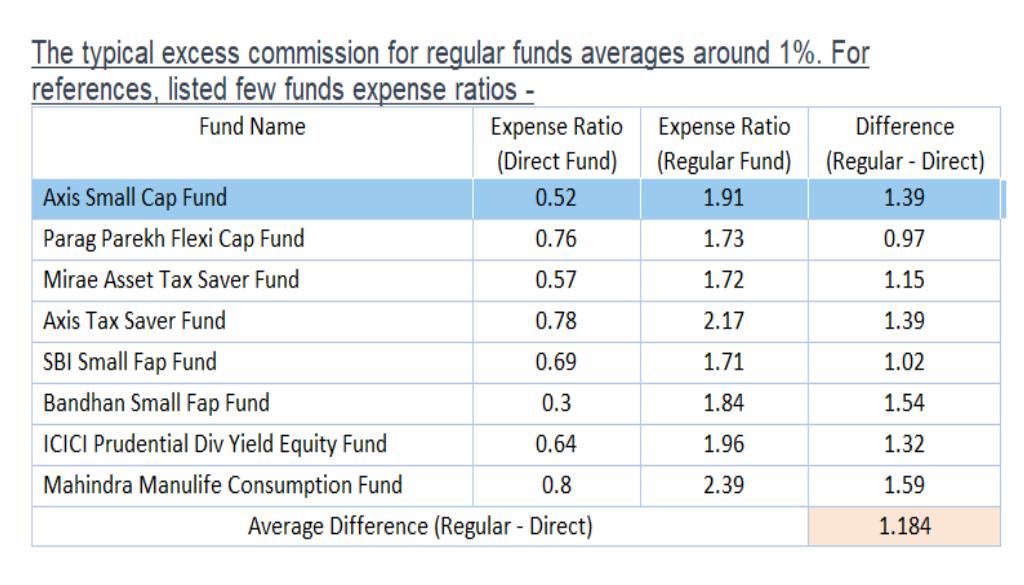

The Compelling Scenario: Direct vs. Regular Mutual Fund Investments – Consider this scenario, a financial crossroads that underscores the tangible benefits of choosing direct mutual funds. If an investor commits to investing 1 lakh per month for 20 years in a direct mutual fund with an average 11% return, the yield would be an impressive 8.74 Cr. In stark contrast, channelling the same amount into the regular version of the same fund over the same duration would generate only 7.66 Cr. The substantial difference arises from the regular fund, incorporating an approximate 1% commission which goes to intermediaries, thereby offering an approximate return of 10%. Choosing the regular fund in this scenario could potentially lead to a loss of around 1.08 Cr compared to the direct fund.

In a world where financial empowerment is paramount, direct mutual funds, fuelled by the technological prowess of fintech apps, are becoming the catalysts for a new era of wealth creation. As more investors recognize the potential of bypassing intermediaries, the financial landscape is evolving, promising greater returns and financial independence for those willing to embrace change. The journey to unlocking substantial savings and building a robust financial future has never been more within reach.

About Author:

Hradayesh Pathak holds an MBA in Finance from XLRI and has successfully passed CFA Level 2