Maharashtra – Biggest Economy of India

Mumbai- December 1, 2015:

Brickwork Ratings, a wholly Indian credit rating agency, released the fourth edition of State Finances Handbook 2015. Brickwork has unique criteria for rating state government that looks at state’s willingness and ability to honor debt obligations. The criterion considers an analysis of political, economic, budgetary, financial and institutional parameters deemed relevant to the state government’s creditworthiness.

Key highlights specific to Maharashtra:

· GSDP: Maharashtra is the biggest state in India by size of economy at ₹ 16.87 lakh crores for FY15 followed by followed by Tamilnadu and Uttar Pradesh at 9.67 lakh crores. The GSDP of the state has grown by 11.69% for FY15.

· Industry: In FY 15, Gujarat and Maharashtra which accounted for 27.26% and 25.18% of GSDP respectively in 2014-15, lead other state economies in terms of level of contribution from manufacturing sector. Other states with higher manufacturing sector share are Tamil Nadu (19.1%), Jharkhand (18.8) and Haryana (18.1%)

· Services: The growth of services sector is largely due to that of IT/BPO/ KPO sector led by Karnataka, Tamil Nadu, Maharashtra and Andhra Pradesh.

· Mortality rates: Maharashtra’s Infant Mortality Rate (IMR) of 25 is below all the states’ average of 50

· Own Tax revenues: Maharashtra earns ~70% of its total receipts has through own tax revenues, which is the highest among the bigger states followed by Gujarat and Tamilnadu.

· Expenditure on General Services: Bihar, Orissa, Tamil Nadu, Kerala spend maximum for pensions while Karnataka and Maharashtra have kept this item of expense reasonable

· Debt and Guarantees: The debt plus guarantees position of the states was about 28.7% of GSDP in FY 15 while the interest payments were around 12.5% of revenue receipts. Andhra Pradesh, West Bengal, Uttar Pradesh, Maharashtra and Tamil Nadu account for about 60% of states’ outstanding debt position.

Overview of the Indian Economy:

· GDP: For the first time in decades, India GDP growth rate at 7.3% in 2015 has exceeded that of China which grew at 6.9%. China has been growing at double digit growth since 1990. India seems to have begun that journey now. Yet the challenges remain, with fund managers perceiving higher risk in merging countries, ease of doing business yet to improve etc. In terms of state performance, GSDP growth rates among the states varied in the range of 7.55% to 39.84% during FY15 in real terms.

· The top three states grew fastest were Bihar at 17.06%, Madhya Pradesh at 16.86% and Goa at 16.43%. The laggards in terms of growth were Telangana at 5.3%, Punjab at 10.16%, Rajasthan at 11%. One can appreciate growth problems in a new state like Telangana with the administrative machinery still evolving.

· Agriculture: In FY15, agriculture on an average contributed about 19% of States’ GSDP, while it remained the mainstay of most states employing over 40-60% of workforce directly or indirectly. In 2015, the top five states with higher share of agriculture sector were Punjab, Madhya Pradesh, Bihar, Andhra Pradesh and West Bengal. Agriculture sector contribution was in the range of 23% to 29% of the GSDP for these states.

· Agriculture remains neglected in spite emphasis by all political parties for sixty years. The pulses and oil seeds production has fallen sharply. India that was earlier dependent on groundnut, coconut and other indigenous oils now imports a lot of consumption requirements. The futures markets are not well developed and farmers have to bear the price risk of crops. That results in everyone going for the same crop like sugar cane and the sugar factories unable to crush the standing cane. Banks are cautious to lend to agriculture due to fears of loan waivers that result in no repayments from rich farmers. Many poor farmers borrow from high cost money lenders and when repayments become difficult, some commit suicide.

· Industry: The contribution of industry to states’ GDP is very low at an average of 27% compared to 40%-47% in other developing countries. Access to finance, regular technology up-gradation, skill enhancement, regular supply of power and market support through stronger links with larger firms have to be improved to boost competitiveness of the manufacturing sector. Gujarat and Maharashtra which accounted for 26.7% and 19.7% of GSDP respectively in 2014-15, lead other state economies in terms of level of contribution from manufacturing sector.

· MSME: India has over 40 Small and Medium Enterprises (SME) clusters. These play an important role in the Indian economy as they account for about 60% of India’s manufactured exports and also a significant share in employment generation. Majority of MSMEs are still under organized sector and these be incentivized to promote growth and enter the organized sector.

· Services Sector: The growth of services sector is largely due to that of IT/BPO/KPO sector led by Karnataka, Tamil Nadu, Maharashtra and Telangana. Together these states accounted for about three fourth of India’s IT exports estimated at $325bn in 2014-15.

· States’ Budgetary Trends: States have embarked on the path to rule based fiscal consolidation that entails better tax administration and reduction of wasteful expenditures. The States’ receipts comprise tax revenue, non-tax revenue, devolutions from the central government and capital receipts consisting mainly of market borrowings and loans from the Centre. In 2014-15, state government revenue aggregated to Rs. 20.89 lakh crores which increased by 18.29% over fiscal year 2013-14. State government expenditure aggregated to Rs. 21.59 lakh crores in 2014-15, increasing by 20.55% over the previous year. Consequently, consolidated Revenue Surplus increased to 2014-15 to Rs. 42,000 crores.

· Trends in States’ Revenues: The States’ own tax and non-tax revenue have contributed between 48% to 51% of total receipts during 2009-15. General slowdown in the economic activity during 2013-14 has impacted both states’ own tax revenues and share of central taxes. This was compensated by higher central grants and market borrowings. Sales tax accounts for about 60% states’ own tax revenues followed by states excise duties at 27% and motor vehicle taxes at 10%.

· Fiscal Transfers: The Constitutional division of responsibilities between the Centre and the States has resulted in higher revenue-raising capability with the Centre rather than the States, while the latter have much higher expenditure responsibilities. To compensate for the mismatch in revenue raising powers of the States vis-à-vis their expenditure commitments, the Constitution has provided for a mechanism of statutory transfer of funds from the Centre to the States through the Finance Commission recommendations. The Fourteenth Finance Commission headed by Dr Y V Reddy, came up with a revolutionary recommendation to increase Centre’s fiscal transfer to states from 32% to 42% of share of taxes. Modi government has to be credited for accepting the recommendations and beginning a new chapter in fiscal federalism.

· Trends in Expenditure: The expenditure responsibilities of the States are mainly directed towards supporting important sectors like education, health and family welfare, agriculture and irrigation, rural development and employment generation. Broadly, the sectors can be grouped under three categories- social, economic and general. During FY14, of the aggregate expenditure of approx. Rs. 16.66 lakh crores, expenditure towards social, economic and general services was about Rs. 14.45 lakh crores. States spent Rs. 1.58 lakh crores for loan repayments.

· Sectoral Analysis of Expenditure: Health, Education and Infrastructure are critical sectors and the outcomes indicators have been have been used to compare progress and disparities across states. Figure 4 shows state-wise sector allocation of funds. On an average, States spent 43% towards social services, 22% towards economic services and 23% towards general services.

· Expenditure on Economic Services: The States that have spent more on economic services are Karnataka, Chhattisgarh, Meghalaya and Goa. Agriculture and irrigation accounts for bulk of expenditure in economic services, with over 10% of total budget allocated to this sector; Energy and Transport sectors account for 4.7% and 4.9% respectively.

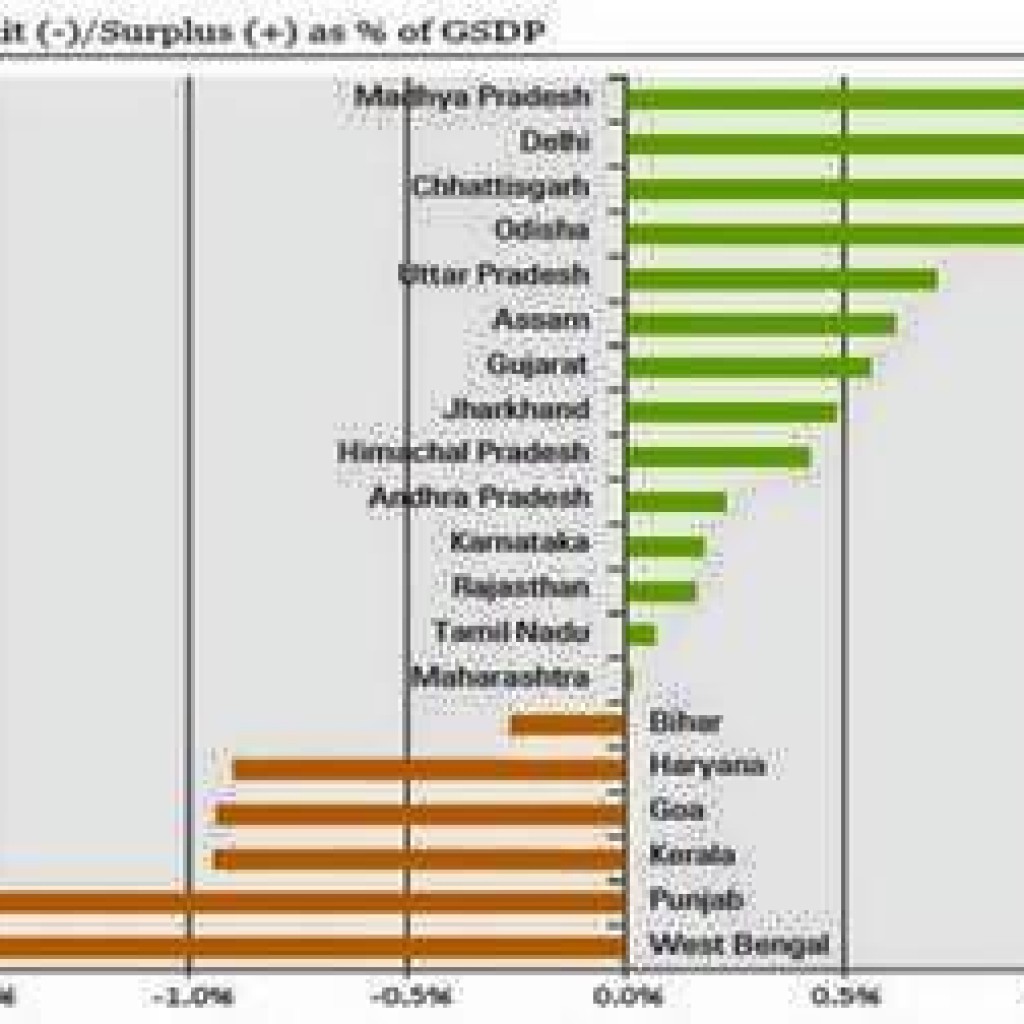

· Revenue Deficits: Fiscal deficit as percent of GSDP (GFD/GSDP) has also not improved for most States during the period 2010-2015. There are more than 10 states which had Fiscal Deficit over the recommended level of 3.0% of GSDP.

· Debt and Guarantees: The debt plus guarantees position of the states was about 21.4% of GSDP in FY15 while the interest payments were around 12% of revenue receipts. Andhra Pradesh, West Bengal, Uttar Pradesh, Maharashtra and Tamil Nadu account for about 60% of states’ outstanding debt position.

· Outlook: An assessment of the investment climate of a state entails careful study of overall risk arising from the linkages between economic, social and financial parameters and inter-state comparisons. A major challenge for the state governments would be to make credible progress towards fiscal consolidation amidst macroeconomic turmoil. The states need to explore sources to boost non-tax revenues and review their policies towards user charges. On the social front, while few states have shown good progress in sensitive indicators, their ability to put in place adequate infrastructure for these services will be vital to ensuring social well-being of citizens. The Centre needs to encourage more decentralization and power to states and local bodies. At the same time there is a strong need for the states proactively undertake expenditure-related reform for sustainable development. Those states that reform their power sector, improve health & education, be investor friendly, reduce corruption at all levels will do well in the future.

Vivek Kulkarni, Chairman, Brickwork Ratings said, “Our objective of undertaking the fourth edition of the nationwide, comprehensive State Finances Handbook is to get a true picture of the transforming profile of India’s finances following similar parameters and metrics of the Government of India. By partnering with various government officials and departments, Brickwork Ratings is seeking to advance understanding, boost awareness and support proper quantification and fund allocation of the various states of our country.”

Readers can log into www.brickworkratings.com and request for the executive summary. Brickwork offers a two hour complimentary seminar on public finances to senior executives of companies, Central & State Governments, Commercial Banks, Capital market intermediaries, Educational institutions, NGOs, etc. Interested persons may get in touch with [email protected] to schedule a session.

About Brickwork Rating India Pvt Ltd

Brickwork Ratings (BWR) is a wholly Indian credit rating agency. Established in the year 2008, BWR is the fifth credit rating agency in India that is registered with SEBI, RBI and NSIC. One of the newest entrants in the league, we have rated over Rs. 500,000 crores of bank loans, bonds and MSMEs. BWR rates an array of financial instruments like bank loans, NCDs and commercial paper. BWR help investors understand the complexity of the investment world by providing quality services to large corporate customers, SMEs, banks, financial institutions, state and local governments.