Pune office space absorption touches 0.9 mn. sq. ft. in Jan-Mar’24

Pune, 4th April 2024: CBRE South Asia Pvt. Ltd, India’s leading real estate consulting firm, today announced the findings of its report ‘CBRE India Office Figures Q1 2024’. According to the report, office space leasing in Pune touched 0.9 mn. sq. ft. in Jan-Mar’24, while supply stood at 0.7 mn. sq. ft.

The report highlighted that Pune office space take-up was driven by small-sized (less than 50,000 sq. ft.) deals during Jan-Mar’24. Moreover, the IT segment accounted for 64% of the total absorption, while the non-IT segment represented 35%. The supply share accounted for 100% in the IT segment.

On a pan-India basis, the office sector in India witnessed a gross absorption of14.4mn. sq. ft. during Jan-Mar ’24 across 9 cities, a decline of 3% (Y-o-Y). Development completions of about 9.8 mn. sq. ft. was recorded in Jan-Mar‘24, declining by 10% (Y-o-Y). The non-SEZ segment dominated development completions with a share of 90%, compared to 88% during the same period in the previous year.

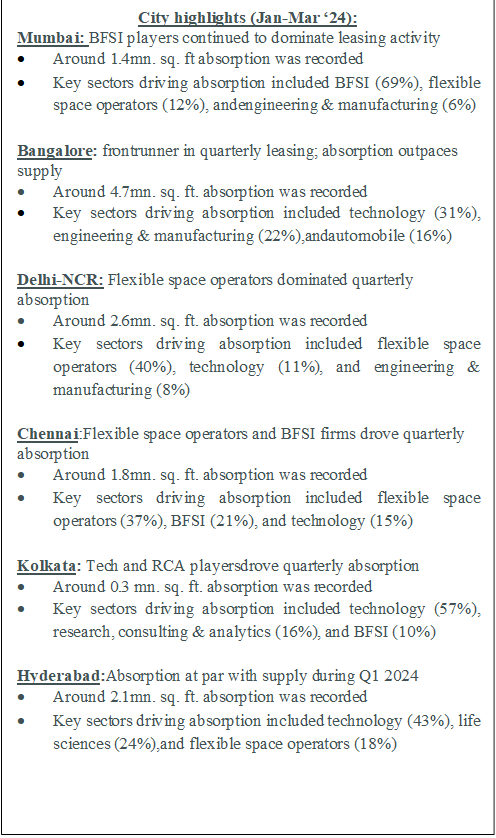

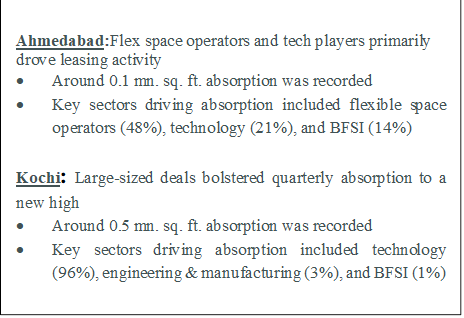

Further, Bangalore led office leasing activity, followed by Delhi NCR and Hyderabad. Together, the three cities together accounted for 65% of the total leasing activity. Nearly half of the leasing during the quarter was led by expansionary initiatives by corporates across the top cities.

Jan-Mar’24period saw technology companies leading with highest share in leasing activity at 26%,followed by flexible space operators at 22%. Engineering and manufacturing (E&M), and banking, financial services, and insurance (BFSI) firms were the other prominent drivers accounting for 13% and 12%, respectively.

Similar to thelast quarter,domestic firms dominated quarterly leasing with a share of 48% in Jan-Mar ‘24, primarily led by flexible space operators, technology firms and BFSI corporates.Further, in technology sector, the space take up was led by software & services with 95% share. The cumulative share of technology companies and flexible space operators increased to 48% during the review quarter compared to 32% in the preceding quarter.

Global Capability Centres (GCCs) accounted for a share of one-third in the overall India office leasingin Jan- Mar ’24. Within the GCCs space take-up, E&M companies contributed to over one-fourth share, followed by automobile firms.Bangalore led the chart for GCC leasing, boasting a 60% share, followed by Hyderabad with 26% and Delhi-NCR with 9%. Notably, 38% of the large-sized deals (exceeding 100,000 sq. ft.) were secured by GCCs during this period, underscoring their significant impact on the office leasing landscape.

Office space take-up was dominated by small- (less than 10,000 sq. ft.) to medium-sized (10,000 – 50,000 sq. ft.) transactions in Q1 2024 with a share of 81%. The share of large-sized deals (greater than 100,000 sq. ft.) in Q1 2024 increased to 8% from 5% during the same period in the previous year. Bangalore and Hyderabad dominated large-sized deal closures in Q1’24, followed by Delhi-NCR and Chennai, while a few such deals were also reported in Kochi, Mumbai, and Pune.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said,“In 2023, the Indian economy continued its growth journey despite rising interest rates and global macroeconomic challenges. This trend of Indian resilience is expected to persist in 2024 with a continued focus on infrastructure development, private investments, and ongoing reforms.

The office sector witnessed meaningful gains in 2023, enhanced by a resurgence in occupiers’ sentiments and pent-up demand after a rise in return-to-offices. During 2024, occupiers would prioritise high-quality office space as they continue to facilitate portfolio expansion and consolidation. India’s inherent advantages, such as its skilled workforce and well-established business ecosystem, continue to hold appeal, leading to a positive outlook for the office sector.”

Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said, “Economic growth and strategic policies are fuelling a dynamic transformation in India’s office market, attracting a wider range of industries. While the technology sector continues to be the mainstay, the broader demand base is reflected in leasing trends, with sectors such as flex, BFSI and E&M exhibiting higher levels of activity. Diversification of office is set to be a key driver for activity across cities. The office activity would be concentrated in major cities such as Bangalore, Mumbai, Hyderabad, and Delhi-NCR. However, higher confidence and availability of talent are expected to propel cities such as Chennai and Pune to witness an upsurge in both leasing activity and development completions, building on from 2023.

Global firms are expected to expand their presence by setting up or expanding existing GCCs. Similarly, domestic firms will likely expand and solidify their presence, strengthened by a period of financial buoyancy and a well-capitalised financial system.”

Outlook and other observations

GCCs to continue being a prime demand driver

- India is poised to remain a prominent market for GCCs, aided by the size of engineering workforce available in the country, competitive costs, and an established ecosystem.

- Existing corporates, buoyed by the success of their current facilities, are actively pursuing operational expansion. Global occupiers from sectors such as BFSI, technology, and E&M would continue expanding their GCC services in India, potentially even venturing into multi-functional centres in 2024.

- Established GCC occupiers with a long-term vision may explore the development of large-scale campuses in India’s top cities.

- Newer entrants are more likely to gravitate towards flexible workspace solutions, offering the advantage of calibrating their operations as required.

- The number of GCCs expected to increase by 20% by 2025, the office sector is poised to witness an influx of small to mid-sized enterprises seeking to upgrade their digital and deep technology capabilities, such as artificial intelligence and machine learning.

Robust pipeline of high-quality, investment-grade supply to continue

- The supply influx is anticipated to remain strong, with a significant portion of investment-grade office space expected to enter the market in 2024.

- Bangalore, Hyderabad, and Delhi-NCR are likely to dominate new completions, followed by Chennai, Pune, Mumbai, and Kolkata. Developers are exhibiting a growing emphasis on building state-of-the-art facilities with amenities catering to the evolving requirements of modern businesses.

- Factors such as convenient access to public transportation systems, a healthy mix of outdoor green spaces, optimum air quality and F&B options are poised to become increasingly prominent features within newly completed developments.

- Going forward, the year is expected to witness a higher proportion of large-sized assets to meet the growing demand, signifying a rise in the popularity of integrated or mixed-use developments.

- Select micro markets across the country are also likely to experience moderate rental growth led by the infusion of new quality supply or low availability of contiguous spaces.

Employee experience on top of occupiers’ agenda

- As office occupancies improve and the workplace evolves into a hub for collaboration, firms are investing heavily in creating bespoke and engaging experiences.

- This trend is likely to see occupiers invest in developing ‘experiential workplaces’ that promote brainstorming, enhance employee productivity, and prioritise well-being. This approach entails the creation of high-quality assets equipped with desirable amenities, fostering a vibrant and engaging work atmosphere.

Sustainable features emerging as ‘must-haves’ in office buildings

- Top office developers are increasingly focusing on constructing green-certified office spaces as the dialogue on sustainability takes centre stage in the real estate sector

- This trend is expected to continue in the coming years, with an anticipated rise in the proportion of sustainable buildings. Furthermore, occupiers are likely to extend their focus beyond mere green certifications.

- Expected to explore a broader range of considerations, including regular measurement of environmental metrics, benchmarking of emissions, and initiatives that enhance the overall social well-being of their employees.