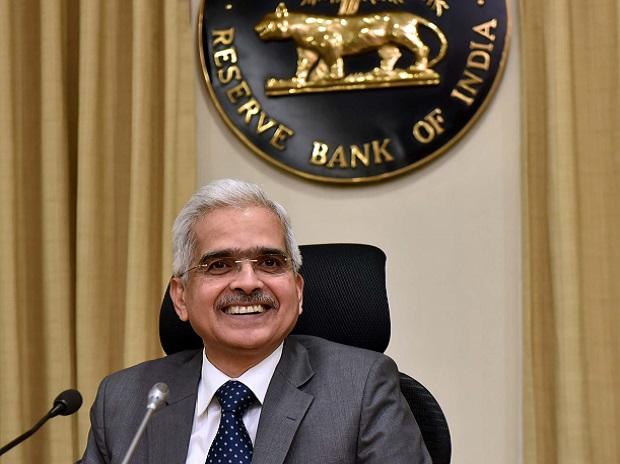

Loan moratorium extended 3 months, repo rate reduced by 0.40% – RBI

New Delhi, 22 May 2020 – Reserve Bank of India (RBI) Governor Shaktikanta Das gave a press conference on Friday. This morning, the Reserve Bank of India gave this information through a tweet. Know the big things of his press conference …

RBI Governor Shaktikanta Das Press Conference Live Updates:

The RBI governor said that it has been decided to increase the group exposure limit of banks by 30 percent.

RBI gives big relief to customers who pay EMI. The period of the lone moratorium increased for 3 more months. Now you can avail loan moratorium till 31st August.

The RBI governor said India’s foreign exchange reserves had increased by $ 9.2 billion.

The RBI governor said that at the policy level, the bank would continue to take decisions as per requirements.

The RBI governor said that the moratorium deadline has been extended to six months.

The RBI governor said that the MPC was to meet on June 3 to 5. He said that there has been a spurt in customers getting the benefit of rate cuts.

The RBI governor said that according to the MCP, inflation is expected to decrease in the second half.

The RBI governor said that there has also been a huge reduction in investment due to a decrease in demand. He informed that merchandise exports fell by 60 percent in April.

The RBI governor said that GDP growth could remain negative in the first quarter of 2021. He said that the financial year 2021 could improve in the second quarter.

The RBI governor said that there has been a sharp jump in food inflation in April. It is 8.6 percent.

The Monetary Policy Committee believes that the inflation outlook is uncertain at present. Das said that industrial production declined by 17 percent in March. The services PMI has remained at the lowest level since April.

The RBI governor said that Kovid-19 has caused a huge loss to private consumption. He said that in the current situation there are expectations from agriculture. Foreign reserves are $ 487 billion.

Shaktikanta Das said that the demand for investment has almost stopped. He said that the biggest impact of the coronavirus will be on private consumption.

Global services PMI has seen a historic decline, Das said. Global business prices may fall by 13–32 percent this year.

The RBI governor said the demand for consumer products declined by 33 percent in the month of March.

He said that the manufacturing PMI was 27.4 percent in the month of April.

The RBI governor said that the services PMI was 5.4 percent in April.

The RBI governor said that 5 out of 6 members of the MCP have agreed to reduce the repo rate.

The reverse repo rate was reduced by the Reserve Bank of India from 3.75 percent to 3.35 percent.

The RBI governor said that the biggest decline in history has been in the Global Services PMI.

The Reserve Bank of India cut the repo rate by 0.40 percent. The burden of loan EMI will be less.

RBI Governor Shaktikanta Das said that the corona virus has had a major impact on the global economy. He said that the MPC policy has agreed to cut the repo rate by 0.40 percent.

In March, the RBI announced several positive measures for borrowers, lenders, and other entities such as mutual funds. Along with this, it was also promised that the central bank will take further necessary steps for the coming circumstances.

Since the monetary policy meeting of February this year, the RBI has injected funds equivalent to 3.2 percent of GDP into the economy to ease liquidity situations.

RBI Governor Shaktikanta Das today can announce an increase in the term of the loan moratorium. It is worth mentioning that the last time he provided a 3-month loan moratorium to the borrowers. Millions of lenders were relieved by this.

The tweet made on Friday said, “Today (May 22, 2020) at 10 am, RBI Governor Shaktikanta Das will address live.” Let us tell you that just a few days ago Finance Minister Nirmala Sitharaman gave a detailed description of the economic package of 20 lakh crore rupees. This economic package was announced by Prime Minister Narendra Modi.